Our Company

The Company was incorporated and registered with the Securities and Exchange Commission (SEC) as “Federal Chemicals, Inc.” on July 12, 1993. At the time, the Company was principally engaged in the business of manufacturing various adhesives and sealants and other chemicals for hardware, construction, do-it-yourself and industrial applications. The Company has been a publicly-listed company since December 21, 2001, and was traded under the ticker symbol “FED” on the Philippine Stock Exchange (PSE).

On September 28, 2007, the change in corporate name from Federal Chemicals, Inc. to Federal Resources Investment Group, Inc. as well as the change in the primary purpose of the Company to that of a holding company was approved by the SEC.

On April 23, 2015, the Board of Directors of the Company approved the issuance of 59,101,000 common shares, at 1.00 per share, out of the unissued portion of the Company’s authorized capital stock to LBC Development Corporation, subject to acceptable documentation being arrived at, as well as the fulfillment of such conditions agreed upon by the parties, including a mandatory tender offer, where required under relevant laws and regulations.

The Company needed to raise additional capital through the issuance of new shares out of the unissued portion of the Company’s authorized capital stock for general corporate purposes. Further, such infusion was preparatory to a potential additional investment of LBC Development Corporation into the Company as a result of the ongoing due diligence on the Company.

On May 18, 2015, the Company and LBC Development Corporation entered into a Deed of Subscription, whereby LBC Development Corporation, subject to the completion of the mandatory tender offer, subscribed to 59,101,000 common shares out of the unissued authorized capital stock of the Company or 59.10% of the authorized capital stock of the Company. The consideration for the subscribed shares was 59,101,000 or 1.00 per share.

On May 22, 2015, LBC Development Corporation filed with the SEC its mandatory tender offer report for all the outstanding shares of the Company for a tender offer price of 1.00 per share. The mandatory tender offer period commenced on June 8, 2015 and ended on July 7, 2015. On July 14, 2015, LBC Development Corporation filed with the SEC its final tender offer report.

On July 22, 2015, the Company issued the stock certificates covering the subscribed shares to LBC Development Corporation.

On 29 July 2015 and in consonance with such change in control, the Board of Directors of the Company approved the acquisition by the Company of all the outstanding shares of stock of LBC Express, Inc., at the time a wholly-owned subsidiary of LBC Development Corporation, at the book value of not less than 1 billion. The Board also approved the following:

(i) increase in the authorized capital stock of the Company from 100 million to up to 3 billion;

(ii) the issuance of shares out of the increase in authorized capital stock or out of the unissued capital stock to LBC Development Corporation and/or to other investors and/or third parties for the purpose of (a) funding the acquisition by the Company of all the outstanding shares of stock of LBC Express, Inc.; (b) funding the acquisition of other potential investments, whether or not related to the business of LBC Express, Inc.; and (c) ensuring compliance by the Company with the minimum public ownership requirements of the PSE;

(iii) the change in the name of the Company to “LBC Express Holdings, Inc.”; and

(iv) the change of the trading symbol “FED” to “LBC”.

On 4 September 2015, the stockholders of the Company approved all of the foregoing matters.

On 18 September 2015, pursuant to the authority to issue shares out of the increase in authorized capital stock or out of the unissued capital stock to LBC Development Corporation, the Company and LBC Development Corporation entered into Subscription Agreements, whereby LBC Development Corporation subscribed to, and the Company agreed to issue, 1,146,873,632 additional Common Shares at a subscription price of 1.00 per share or an aggregate subscription price of ?1,146,873,632 (the Additional Subscriptions), consisting of 475,000,000 shares issued from the increase in the authorized capital stock of the Company and 671,873,632 shares issued out of the authorized and unissued capital stock of the Company, following the approval by the SEC of the increase in the authorized capital stock of the Company from 100,000,000.00 divided into 100,000,000 Common Shares with par value of 1.00 per Share, to 2,000,000,000.00 divided into 2,000,000,000 Common Shares with par value of 1.00 per Share. Notices of exemption for the Additional Subscriptions were filed with the SEC on October 13, 2015.

On September 24, 2015, the Company purchased from LBC Development Corporation a total of 1,041,180,493 shares of stock in LBC Express, Inc. for an aggregate purchase price of 1,384,670,966.

On 2 October 2015, the Company entered into Subscription Agreements with each of Vittorio P. Lim, Mariano D. Martinez, Jr., and Lowell L. Yu (collectively, the Subscribers), wherein subject to the approval by the SEC of the Capital Increase, the Subscribers agreed to subscribe, and the Company agreed to issue, a total of 178,991,839 Common Shares of the Company at the par value of P1.00 per share or an aggregate subscription price of ?178,991,839.00 out of the authorized and unissued capital stock of the Company. The foregoing subscription was undertaken to ensure compliance by the Company with the PSE Minimum Public Ownership requirement of at least 10% of the outstanding capital stock of the Company. A notice of exemption for the subscription was filed with the SEC on October 13, 2015.

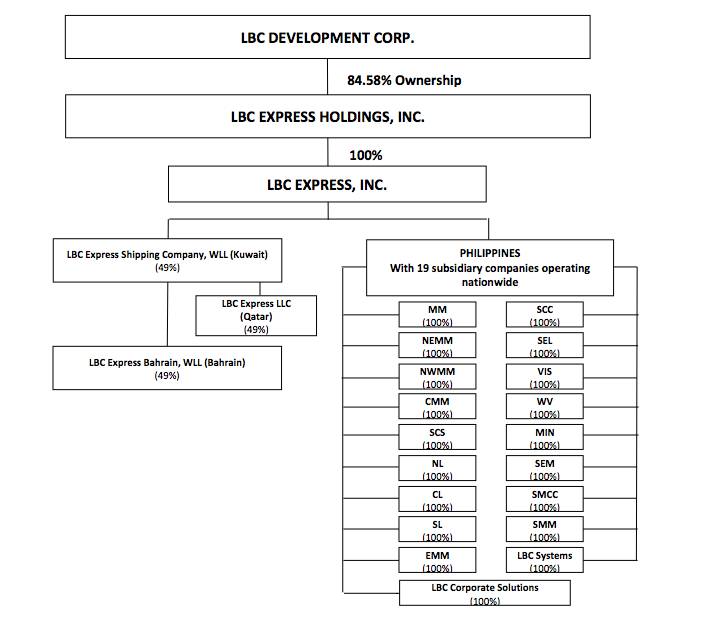

The 19 subsidiaries of the Company which are incorporated in the Philippines are involved in logistics and money remittance operations while the entities incorporated in Kuwait, Bahrain and Qatar are involved in logistics activities only.

Except for LBC Express - SMCC, Inc. and LBC Express - SMM, Inc., the principal offices of the 17 other subsidiaries named above are located in the General Aviation Center, Domestic Road, Pasay City. The principal office of LBC Express - SMCC is located in Door No. 7, Yabon Building, Darimco Silawy, Dadiangas West, General Santos City, while the principal office address of LBC Express - SMM, Inc. is located at the 3rd Floor Sycamore Centre, Alabang Zapote Road, Alabang, Muntinlupa City.